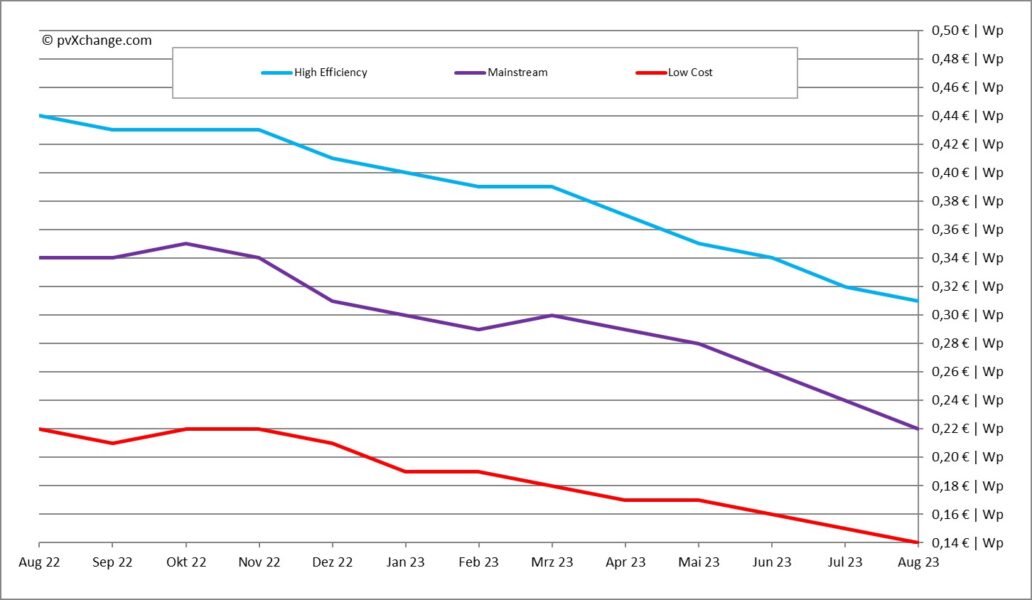

Solar module prices continue to fall

pvXchange module price index, as of August 2023 Image: pvXchange.com

For the fifth month in a row, module prices fell further by around 6% on average. The ongoing decline in prices has led to an overall

average reduction of 25% across all module technologies since the start of the year.

Even as raw material costs in China stabilize, high inventories continue to drive down module prices. Manufacturers and wholesalers

are grappling with recurring losses in their day-to-day operations. To clear these accumulated stocks, discounts must be offered, and

those unwilling to sell below production or purchase prices face the prospect of losing out.

In response, Asian manufacturers are managing the situation by curbing the filling of European warehouses and reducing replenishment.

However, the pressure to sell persists as existing inventories depreciate on a weekly basis. Some module customers are attempting to

exit current supply contracts or cancel standing orders. However, such actions are not straightforward and come with potential high

penalties. Adjusting the purchase price slightly is advised during these negotiations.

The duration of this challenging market scenario remains uncertain. The situation could improve as PV demand potentially picks up in

Europe during late summer, coupled with the year-end rally in the Chinese market. Nonetheless, the exact extent of solar panel stockpiles,

particularly of PERC technology, in European warehouses and the timeline for clearing this excess remain uncertain. Further price reductions

are anticipated in the upcoming weeks and months.